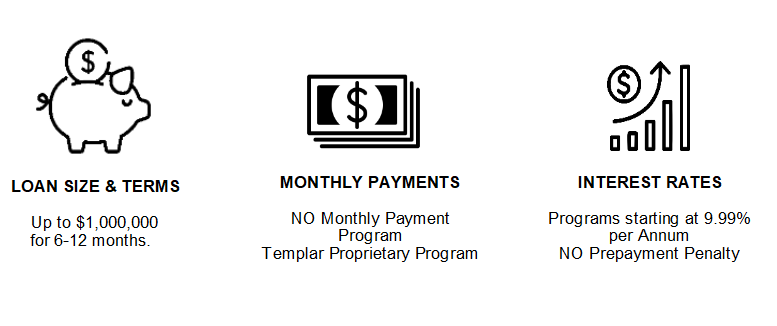

Loan Program

An investor/rehabber can use a private loan as a lending tool for financing when he/she only plans on holding the investment property until the construction or rehab work has been completed and the property goes to sale. A construction loan will typically be disbursed in increments as a borrower needs funds to complete construction of the property. Once a property has been constructed and/or renovated and sold for a profit, the loan with the private lender is paid off in full. The typical maximum loan-to-value allowed on a subject property is 70% with disbursements made to a borrower pursuant to the terms and conditions of a construction holdback agreement signed at closing.